Disruptive innovation is a concept that has transformed many sectors, promising growth and technological revolution. However, despite its potential, it also entails a series of risks that investors need to understand thoroughly before committing to this type of investment.

Risks Associated with Disruptive Innovation

1. Market Risk:

Companies operating in the field of disruptive innovation often find themselves in new and rapidly evolving markets. This dynamism can lead to greater volatility and uncertainty. The lack of an established performance history and the rapid pace of technological changes make it difficult to predict long-term success.

2. Disruptive Innovation Risk:

Not all disruptive technologies achieve the expected success. Widespread adoption and commercial success are not guaranteed, and some technologies may fail to realize their full transformative potential. This can lead to significant losses for investors who have bet on these innovations.

3. Regulatory Risk:

The rapid advancements of disruptive technologies often outpace existing regulatory frameworks, creating uncertainty and potential legal challenges. Regulations can significantly impact growth projections and business models, making it essential for companies to operate with an eye on possible legislative changes.

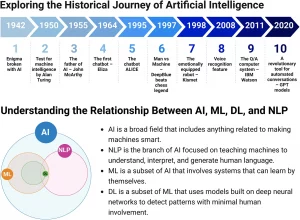

4. Deep Learning Risks:

Deep learning, a branch of artificial intelligence, heavily relies on large datasets. The accuracy and reliability of these models are closely tied to the quality of training data. Additionally, ethical concerns and potential biases in deep learning models could lead to unforeseen negative consequences, further complicating the investment landscape in this technology.

Additional Considerations

Competitive Landscape:

Evaluating the competitive landscape is crucial. Investors must understand not only the technology itself but also how political, legal, and market pressures can influence the sector. The presence of strong competitors and market evolution are determining factors for long-term success.

Uncertainties and Unknowns:

Forecasts related to disruptive innovation are subject to many uncertainties. Rapid technological advances, changes in market dynamics, and unforeseen developments can significantly impact actual outcomes. Recognizing these uncertainties is essential for a realistic assessment of investments.

Due Diligence:

Investors should conduct thorough research and carefully evaluate potential risks. Consulting experts and industry professionals can provide a clearer and more detailed view of the opportunities and risks associated with disruptive innovation.

Disruptive innovation offers tremendous opportunities but also significant risks. Disruptive technologies can revolutionize sectors and generate substantial growth, but it is crucial to approach such investments with caution and a clear understanding of potential risks. Only by understanding the evolving landscape, carefully evaluating risks, and adopting a disciplined approach can investors successfully navigate the complexities of disruptive innovation, positioning themselves to take full advantage of emerging opportunities.